0% Income Tax is Managed Decay

The shift is to a Value-Added Tax Scheme like Europe's and away, while always maintaining their high levels of spending.

According to the Missouri Independent, Mike Kehoe stated during the campaign, “Since I’ve been in state government, we’ve cut the income tax from 6% to 4.7%,” Kehoe said. “I have backed $2.4 billion in tax cuts since I’ve been in office. But now, we need to take that to zero. That’s a key to our economic development strategy.”

He’s working closely with two organizations, Americans for Prosperity and the American Legislative Exchange Council, to help push bills through this session to accomplish his campaign promise.

@RareCamellia [Camellia Peterson] is an AFP Lobbyist, self-declared Libertarian [Big-Government Libertarian], and School Choice [Tax-Funded Private and Homeschools] proponent. Experience has shown that it is always worth investigating how her benefactors manipulate the tax code if she is behind something.

Missouri's 2025 legislative session has revealed two competing visions for tax reform, each with dramatically different impacts on how Missourians will pay taxes. One plan aims to directly reduce taxes, while another reorganizes how taxes are collected while maintaining state revenue.

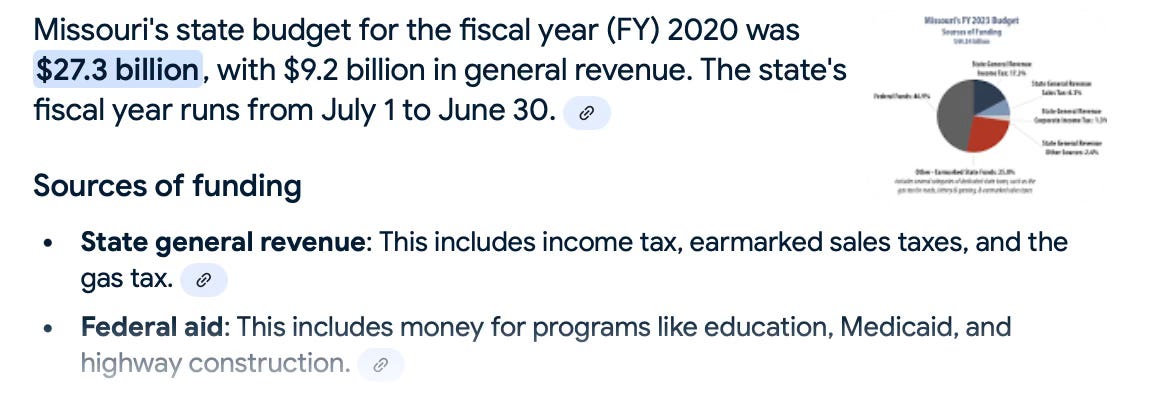

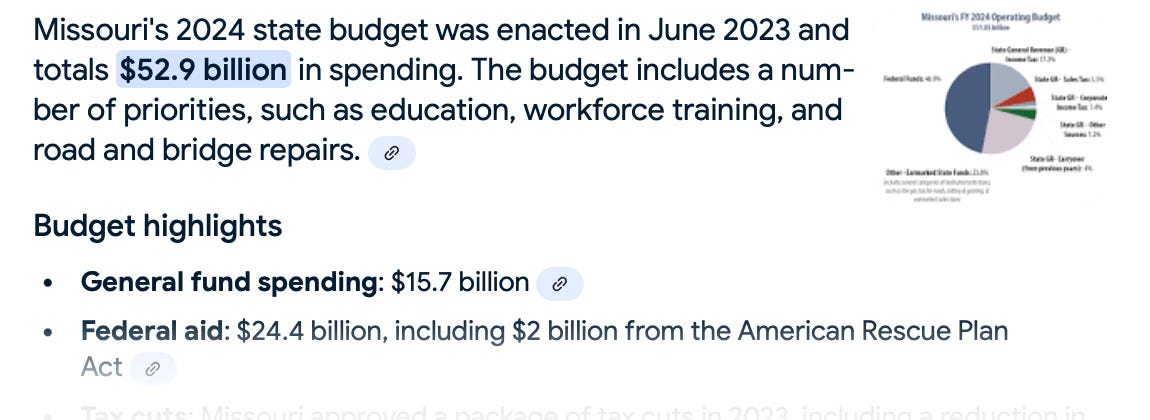

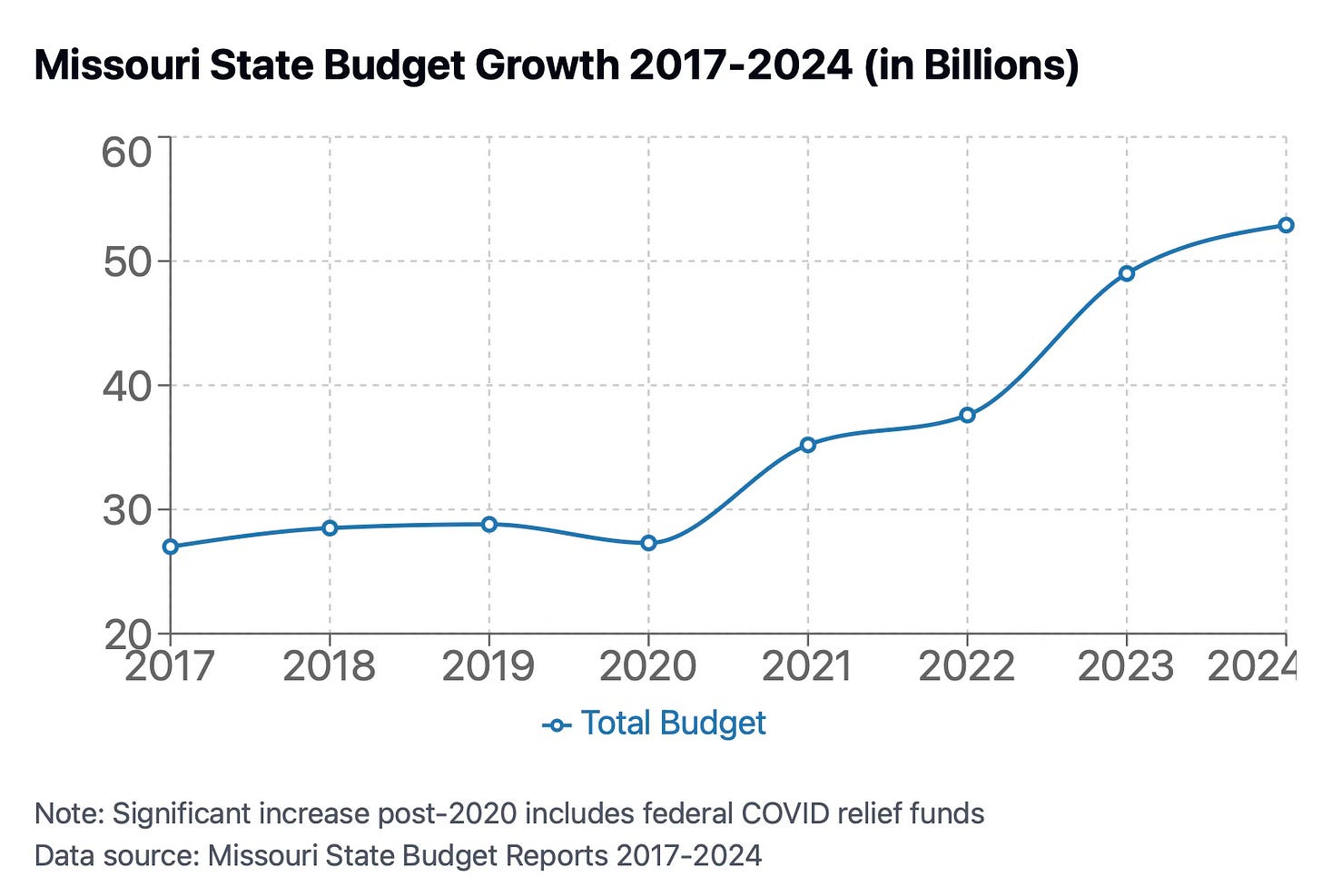

The bill Kehoe supports doesn’t reduce spending, though I am sure they will claim their pretensions of tax cuts. Under Kehoe’s tenure as Lt. Governor, spending in Missouri doubled from ~$27B to ~$52B. This year, his budget is $54B. Kehoe stated they cut $2.4B in tax cuts, yet they spent so much money that it is hard to see where the tax cuts occurred.

Bill Sponsors

Senator Mike Moon, widely recognized as the Senate's most conservative member, has introduced Senate Bill 1029. His proposal would phase out corporate income tax entirely by 2029, reducing it by 0.8% each year until it reaches zero.

On the other hand, Representative Bishop Davidson, not known for conservative values, introduced House Bill 100 and House Joint Resolution 1. These bills are backed by Americans for Prosperity (AFP), a pseudo-conservative advocacy group, and the American Legislative Exchange Council (ALEC), an organization that develops model legislation for state lawmakers.

Bills are often written by front groups like ALEC, who then convince Reps like Davidson to present them in exchange for support during their runs for office. Reps like Davidson rarely read the bills but are convinced easily because they want the office and the prestige that comes with the office.

Several senators, including Curtis Trent, Ben Brown, Nick Schroer, and Jill Carter, have filed identical bills to increase the chances of passage. These senators have shown more interest in serving their own re-election than their constituents.

Two Different Approaches

Moon's approach is straightforward: remove corporate taxes that businesses currently pass on to consumers through higher prices. Companies paying less in taxes can reduce prices on everyday items like groceries, shoes, and gas. His bill states, "Beginning with the 2029 tax year, there shall be no income tax on corporate income."

The AFP/ALEC plan is far more complex—this complexity is purposeful. They don’t want you to be able to read it or understand it. They disguise it using legal code. While marketed as an income tax reduction, it introduces a European-style consumption tax system known as the Value Added Tax (VAT). Here's how it works:

First, they expand what can be taxed. The plan removes Missouri's current ban on taxing services (adding a new tax) and sets a sales tax rate of "three and seven hundred seventy-five thousandths percent" on goods and services. This means you'll pay taxes on products and services like car repairs, haircuts, and professional fees.

This is taking more money out of your pocket that you can’t afford and giving it not to the business owner but to the government. Taxes—corporate taxes—always go to the government. They don’t go to the business. The people who pay for them are the end consumers—you and me. Mike Moon understands this. AFP/ALEC also assumes you’re stupid and will be easily fooled.

Second, they create a "Tax Reform Fund." The bill states, "if the amount of net general revenue collected exceeds the anticipated general fund revenue expenditures for a fiscal year by one million dollars or more," that extra money goes into this fund.

Finally, they promise income tax relief, but with conditions. The law says income tax rates can only be reduced "if the tax reform fund reaches and maintains a minimum balance that is greater than or equal to one hundred twenty million dollars." In other words, you'll only see income tax relief if the state collects enough extra money from the new service taxes.

Here is Mike Moon’s Plan:

People won’t give the government any more money when they buy goods through corporate taxes.

The end.

Here is the AFP/ALEC Plan

People will now have a new tax through haircuts, car repairs, and professional services.

People will pay more for groceries, gas, and goods.

If people have paid enough money through the VAT tax system and been good boys and girls, and only if the government gets $120M in reserves will they get an income tax break.

There are no guarantees that there will be a reduction to 0%. It’s only proposed.

The government does not have to reduce its spending but is encouraged to spend more under this model. Under Mike Moon’s model, the government has to reduce its spending because it generates less revenue from the taxpayer.

Understanding the European Model

The AFP/ALEC plan mirrors the Value Added Tax (VAT) system used in Europe. Under a VAT system, taxes are built into the price of goods and services at every step of production and sale. While your paycheck might look bigger because of reduced income tax, you'll pay more every time you purchase anything from a good to a service.

So, the corporations still have to pay their taxes to Missouri every step of the way under the AFP/ALEC plan, which gets pushed to you. Then, they will add new taxes, which get driven to you again. The corporation doesn’t pay taxes on anything. The consumer pays taxes on everything. Taxes for a business are a cost built into the price of every tube of toothpaste, every roll of toilet paper, and every bag of Tostidos.

The AFP/ALEC plan doesn’t assist you or save you money unless you can somehow drop out of the economy and live as a homesteader. Yet, this won’t work because they will rely on income tax if you do. You would have to quit working and buying not to pay any taxes into their system. A few of us are hardy enough to do that, but most of us do not have the resources to live as a homeless person.

Think of it this way: Moon's system recognizes that government taxes on businesses make your groceries, shoes, and gas more expensive. He wants to make those items cheaper by removing those taxes. The AFP/ALEC system says they'll give you more money in your paycheck, but only after you've paid higher prices on everything you buy and if the state collects enough revenue from those higher prices.

Impact on Missourians

The difference between these approaches is significant. Under Moon's plan, corporate tax reduction would directly lower business costs, potentially reducing consumer prices.

Under the AFP/ALEC plan, while your paycheck might eventually show less tax withholding, you'll pay new taxes on services and likely higher prices on goods to make up for it without forcing the government to be lean or to force the government to reduce its budget. If the government never reduces its budget, it may have enacted a VAT and an income tax system, which we’ll never get rid of.

Governor-elect Mike Kehoe has promised to eliminate Missouri's state income tax—but you can be sure he will plan to increase your tax burden. The state receives 65% of its revenue ($13.35 billion) from income taxes. [Consider how much of our revenue comes from other sources and how much we overspend right now.]

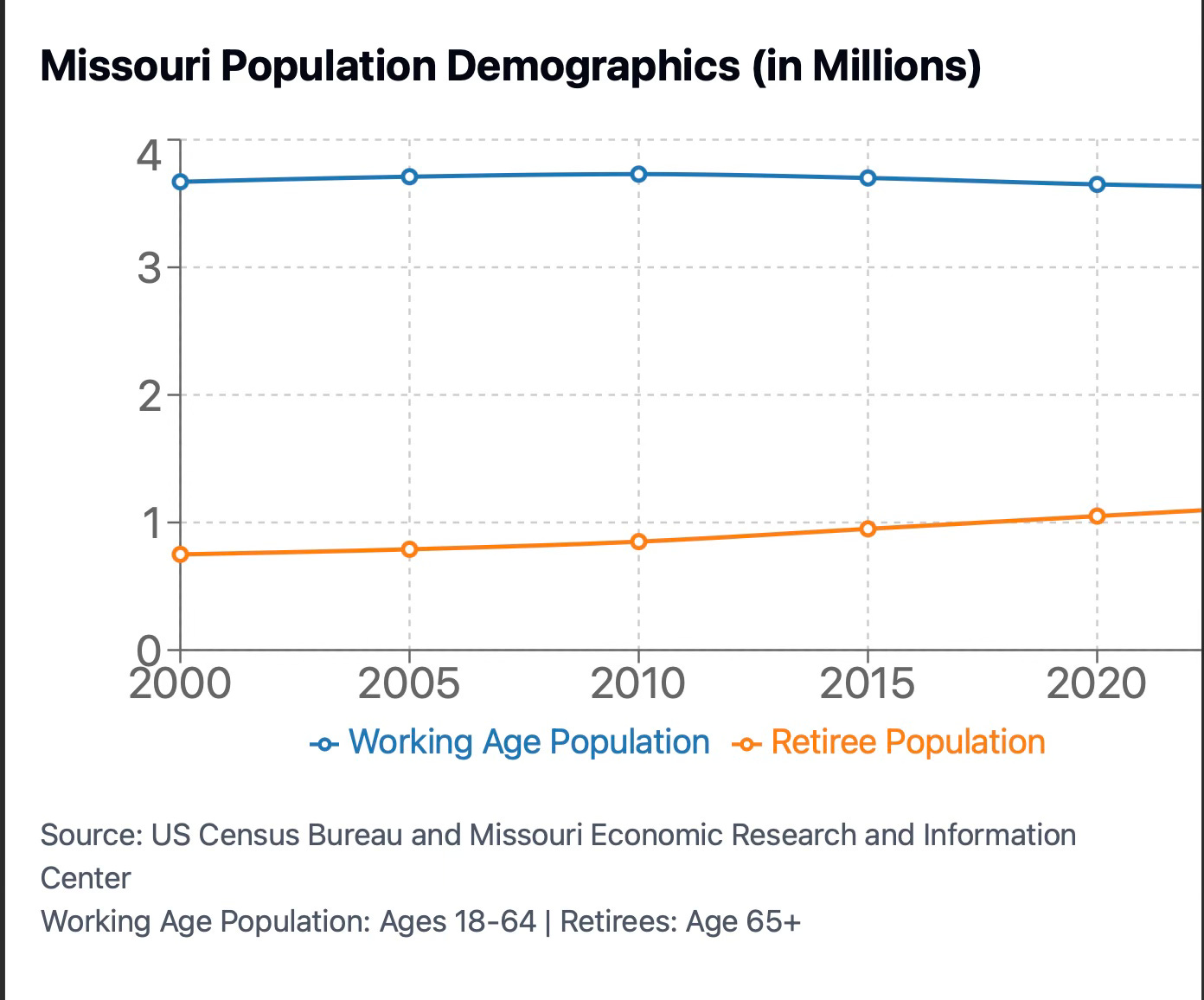

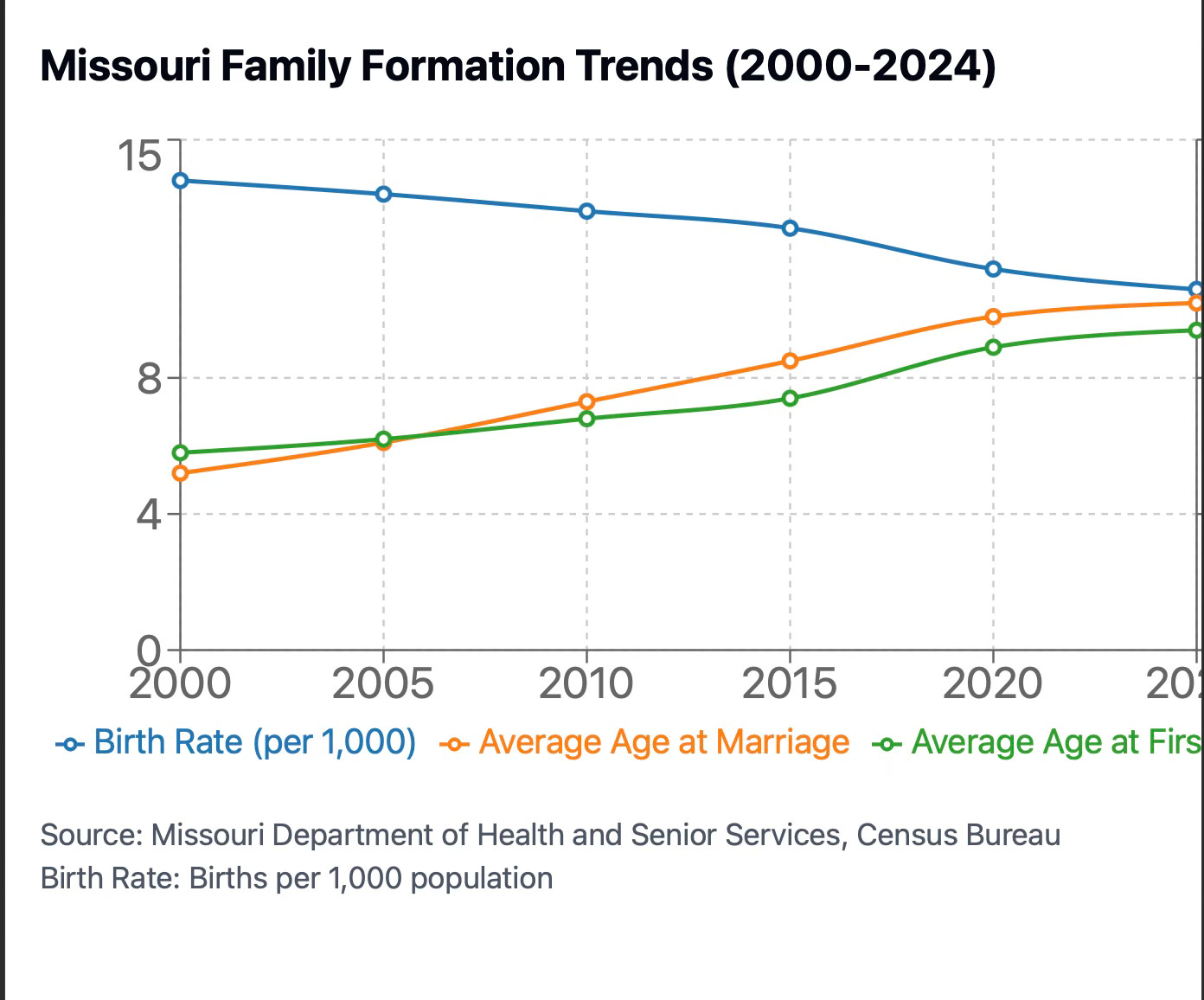

In 2024, Missouri’s income tax declined for the first time. Our population is flat and not growing. Our children are not being born. Our people are retiring and aging out of the job market.

Do you understand why they want a VAT? Because they can tax retirees using a VAT when they can’t tax their retirement accounts. This is about an aging population that must be taxed to maintain enormous expenditures.

With more young people postponing families, birthrates plummeting, and family formation not occurring until a later age, AFP/ALEC is also calculating they can take more of the expendable income from these young individuals rather than encourage them to have families and have children. They are managing our decline rather than trying to head it off. They have decided the culture war is lost (a strange thing for supposedly conservative groups to give up on), and they are helping RINO legislators capitalize on it to spend more money like Democrats.

The AFP/ALEC plan ensures this revenue continues through expanded sales taxes, while Moon's plan seeks an actual reduction in total tax collection.

For Missouri taxpayers, the choice is between a genuine tax reduction that could lower prices and our budget versus a restructuring that maintains state revenue while making taxes less visible. While the AFP/ALEC plan's promise of zero income tax sounds appealing, the reality is that Missourians could end up paying the same amount or more in total taxes, just in a different way.

The battle over these competing visions will likely define Missouri's 2025 legislative session. Kehoe’s plan, backed by the AFP/ALEC, aims to continue spending at unsustainable levels through a regressive tax structure to take money from families who can’t afford to spare it.

Mike Moon plans to reduce the costs for every family across the state by removing the government’s invisible hand from business costs that we don’t see in gas, groceries, and goods. Mike Moon’s plan doesn’t add a new tax to our services or lock us into a new tax in our code that we may never remove again.

Conclusion

The contrast between these approaches reveals more than competing tax policies—it exposes fundamentally different visions for Missouri's future.

The AFP/ALEC plan represents sophisticated bureaucratic management that accepts demographic decline as inevitable. It aims to maintain high government spending through complex tax mechanisms by shifting tax burdens to young professionals and retirees while making taxation less visible but more pervasive. It's a nuanced strategy for managing Missouri's diminishing population and changing demographics without addressing the root causes of decline.

Moon's approach, by contrast, represents a vision of economic liberty. By removing corporate taxes that inflate the cost of everyday goods, his plan returns money directly to people's pockets. This gives families more resources for formation and growth while forcing the government to operate within reduced means. Rather than managing decline through bureaucratic complexity, it trusts Missourians with their own economic choices.

The fundamental difference isn't just about tax rates or revenue collection. It's about whether Missouri will accept and manage its decline through sophisticated tax schemes or potentially empower its citizens through economic freedom to reverse these trends.

Moon's straightforward plan offers a genuine reduction in tax burden and government scope, while the AFP/ALEC proposal ensures continued high spending through an intricate web of consumption taxes.

For Missouri's future, the choice is between managing decay and enabling renewal.

Follow me on X @HickChristNews

Where are the offset bills to reduce spending to cover either of these tax elimination bills?

Corporate tax runs perhaps a $1 billion a year?

Individual tax runs around $8.5 billion a year?

Why the legislature is not trying to move back to 2020 budget amounts is beyond me.

I moved here in 2017. Every year my home-lender bank revises my escrow payment up to cover the cost of insurance and PP tax. This is what will happen to the Vat-tax every year because the legislature has proven it is growth happy and immune from fiscal responsibility. I moved from a state with no sales tax and an individual income tax rate comparable to MO's.

MO already has a sales tax and yet it now wants a Vat. No thanks, although I believe that taxing productivity is insane and taxing consumption is appropriate (with exceptions like food) with perhaps a yearly rebate for very low-income families.

There needs to be a computation applied to State spending. How about increases not to exceed 1% in year over year expenditures (budget)? It is hard not to assume that the cities/counties and state have gleaned revenue increases from the increase in overall pricing on products and goods. One would think a lower sales tax is in order.

"Moon's approach, by contrast, represents a vision of economic liberty. By removing corporate taxes that inflate the cost of everyday goods, his plan returns money directly to people's pockets. This gives families more resources for formation and growth while forcing the government to operate within reduced means. Rather than managing decline through bureaucratic complexity, it trusts Missourians with their own economic choices."

Yes! That's right.