5% or Bust—Library Foundations belong to the Library—They are not Independent

The supposed independence of a nonprofit is a false narrative. New documents form the policy manual demonstrate that they are actually tightly linked, giving the Library oversight of both.

Deliberate Financial Caps Uncovered

A recently discovered policy document reveals a deliberate mechanism designed to maintain library control over supposedly "independent" support organizations while simultaneously avoiding financial transparency. The Christian County Library's "Annual Financial Information Sharing Audit Requirements for Recognized Support Organizations: The 5% - 5 Year Policy" establishes a critical threshold that explains why these organizations keep their contributions artificially low—if they seek too much funding, they might trigger an audit which might be embarrassing for everyone.

The Foundation website link is broken. You can visit old Venmo and PayPal links, but overall, the impression appears as professional as a project done by a 4th grader twenty years ago.

Do they want this to be the landing page for donations? Or are they chasing away donations? If they are chasing donations away, is the grant writer position at the Library only there to win favor with the public?

The Policy Framework

The policy, updated in November 2019 shortly after the library's budget dramatically increased from under $1 million to over $4 million, states:

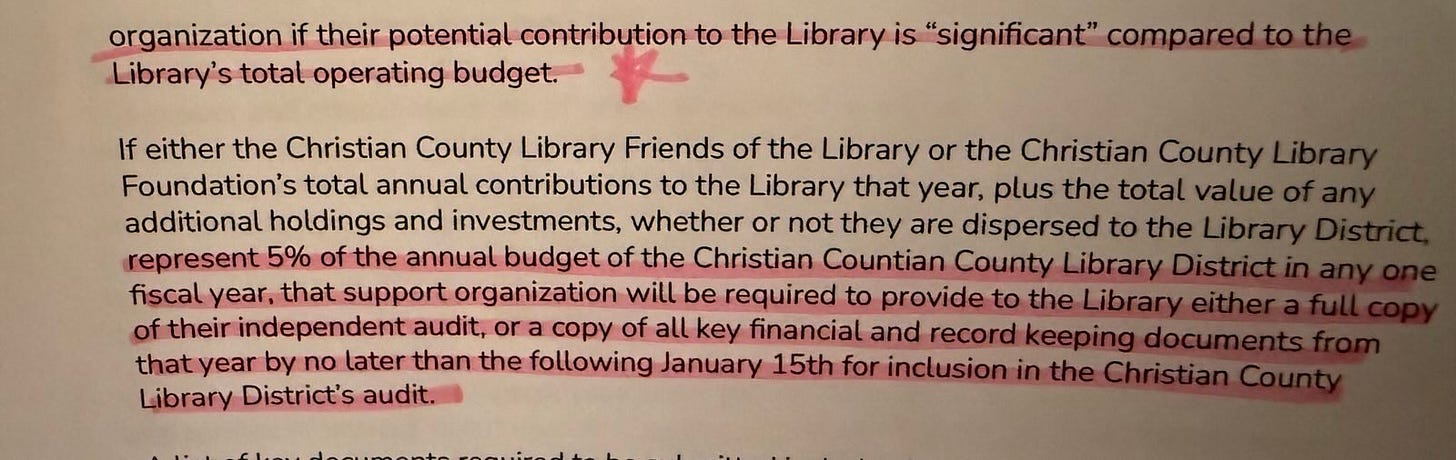

"If either the Christian County Library Friends of the Library or the Christian County Library Foundation's total annual contributions to the Library that year, plus the total value of any additional holdings and investments... represent 5% of the annual budget of the Christian County Library District in any one fiscal year, that support organization will be required to provide to the Library either a full copy of their independent audit, or a copy of all key financial and record keeping documents from that year..."

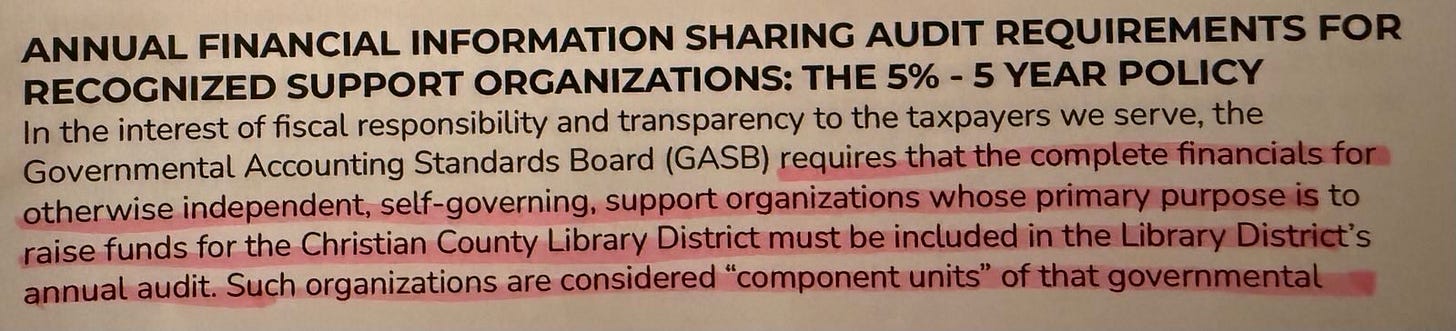

The policy further explains that these organizations are considered "component units" under Governmental Accounting Standards Board (GASB) requirements:

"In the interest of fiscal responsibility and transparency to the taxpayers we serve, the Governmental Accounting Standards Board (GASB) requires that the complete financials for otherwise independent, self-governing, support organizations whose primary purpose is to raise funds for the Christian County Library District must be included in the Library District's annual audit."

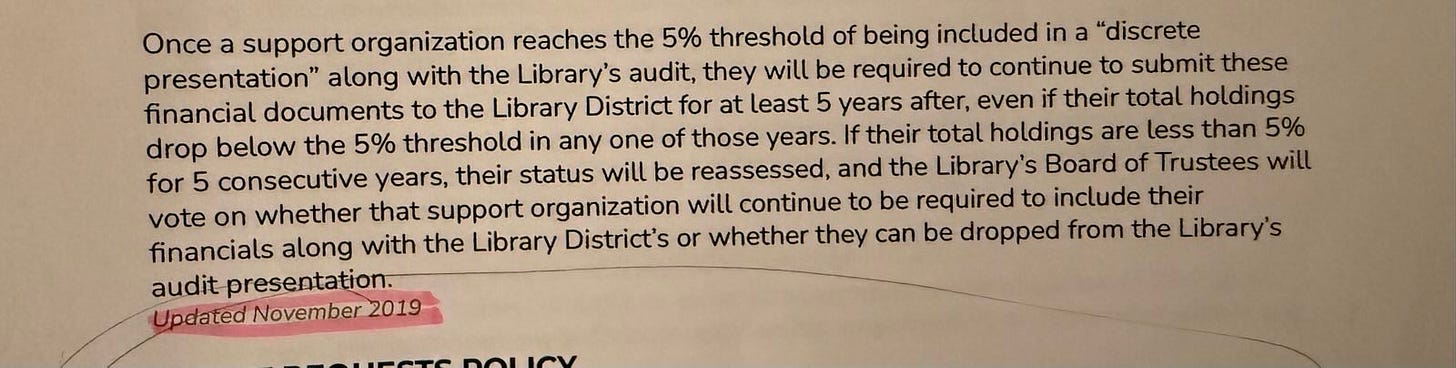

Once an organization triggers this reporting requirement by crossing the 5% threshold, they remain subject to it for five years, even if their contributions subsequently drop below 5%.

Strategic Implications

This policy has profound implications for understanding the relationship between the Christian County Library and its supporting organizations:

Deliberate Contribution Throttling: The 5% threshold (approximately $200,000 in a $4 million budget) creates a strong incentive for these organizations to keep their contributions artificially low to avoid financial transparency requirements. However, as I covered yesterday, they can only reach a max 1.25% before they reach the $50K threshold of reporting to the IRS. They are threading the needle between the IRS and the GASB.

Official Recognition of Control: The policy officially defines these organizations as "component units" of the library system, directly contradicting their claims of independence. When the Foundation’s Secretary Ruth Ann Maynard tries to get on the Library Board of Trustees in November, there may be a conflict of interest. When she speaks in front of the Commissioners as an independent agent, there may be a conflict of interest. When Lonnie Brandon, president of the Friends of the Library speaks in front of the Commissioners, worrying about the Library closing (presaging the same worries as Maynard), there may be coordination between them and the library. Caleb Carter also spoke. He told us a story about how his grandma was a democrat. Did they Library threaten these board members with their positions if they didn’t show up and defend them?

Post-Tax Bond Implementation: The timing of this policy's update is particularly telling—coming shortly after the library secured its increased tax funding, suggesting a deliberate strategy to maintain control while avoiding transparency. In 2017, the Library’s budget was under $1M and did not trigger the Missouri Ethics Commission oversight. After the tax bond, it increased dramatically, expanding from two buildings to four, and hiring up to 60 staff, including just six in marketing who just deal with social media and the media. This dramatic increase hides how much money they spend, while also hiding their relationships with these “independent” nonprofits.

The Evolution of Control

The historical context surrounding this policy is crucial to understanding its purpose. In 2013-2014, the Christian County Library Foundation was actively established to raise significant funds for library expansion. As Katy Pattison, then assistant director of the library, wrote in a December 2014 fundraising appeal:

"The Christian County Library Foundation was established in 2013 to raise money toward future expansion of library facilities and services in the county."

In this pre-tax bond period, the library actively encouraged substantial financial contributions from its supporting organizations. The foundation even secured a $100K grant at one time, more than 10% of the library’s budget at the time. However, after securing the larger tax-funded budget, the implementation of the 5% threshold policy effectively disincentivized large contributions that would trigger audit requirements. The Library only needs taxpayer funds from your property taxes and raises the bare minimum to keep up appearances with the other nonprofits.

The Control Mechanism in Action

This policy explains the pattern of relatively small financial contributions from both the Friends and Foundation, despite their stated missions of significant library support. By keeping contributions below the 5% threshold, actually below 1.25% for the IRS, these organizations avoid the transparency requirements that would expose their true relationship with the library.

This creates a system where:

Library staff can effectively direct the activities of these organizations while maintaining the appearance of independence

The organizations can engage in political advocacy and content defense activities that the library itself might face scrutiny for

Financial transactions remain shielded from the public audit process

Circular Logic: Funding Without Transparency

The policy creates a circular relationship where:

Books and materials purchased with taxpayer funds are removed from the library collection

These materials are given to the Friends for sale

The Friends return a reduced value of the proceeds to the library, carefully staying below the 5% threshold. It’s important that they sell the books for next to nothing and under their true valuation.

This cycle continues while avoiding financial transparency requirements

This institutionalized system keeps the support organizations in a position where they can serve library administration priorities without facing the same public scrutiny or transparency requirements as the library itself.

The 5% threshold policy is not just an administrative detail—it's the foundation of a system designed to maintain control while creating the appearance of independent community support.

This document provides concrete evidence that despite claims of separation, these organizations function as extensions of library administration, allowing staff to pursue initiatives that might face public scrutiny if handled directly through the library's budget.