Questionable Retirement Plan Raises Ethical Concerns

An investigation reveals Ozark R-VI School District implemented a controversial retirement plan allowing administrators to shield portions of leave payouts and bonuses from taxes--Was it ethical?

An independent investigation has uncovered details about a retirement plan implemented by the Ozark R-VI School District that raises potential ethics concerns over excessive compensation practices for top administrators.

Dr. Bauman retired last year in 2023 because of the continued medical needs of his wife. As someone who has had family with cancer, I sympathize with Dr. Bauman and am not attacking him or disagreeing with him in his choice—my wife has made similar choices because of my own health concerns. I support and agree with Dr. Bauman retiring for his wife.

When health concerns hit a family, there is often many hard choices which must be made. My article is about how the School Board’s decisions, through Dr. Bauman’s retirement, may demonstrate they were not good stewards of the taxpayer funds.

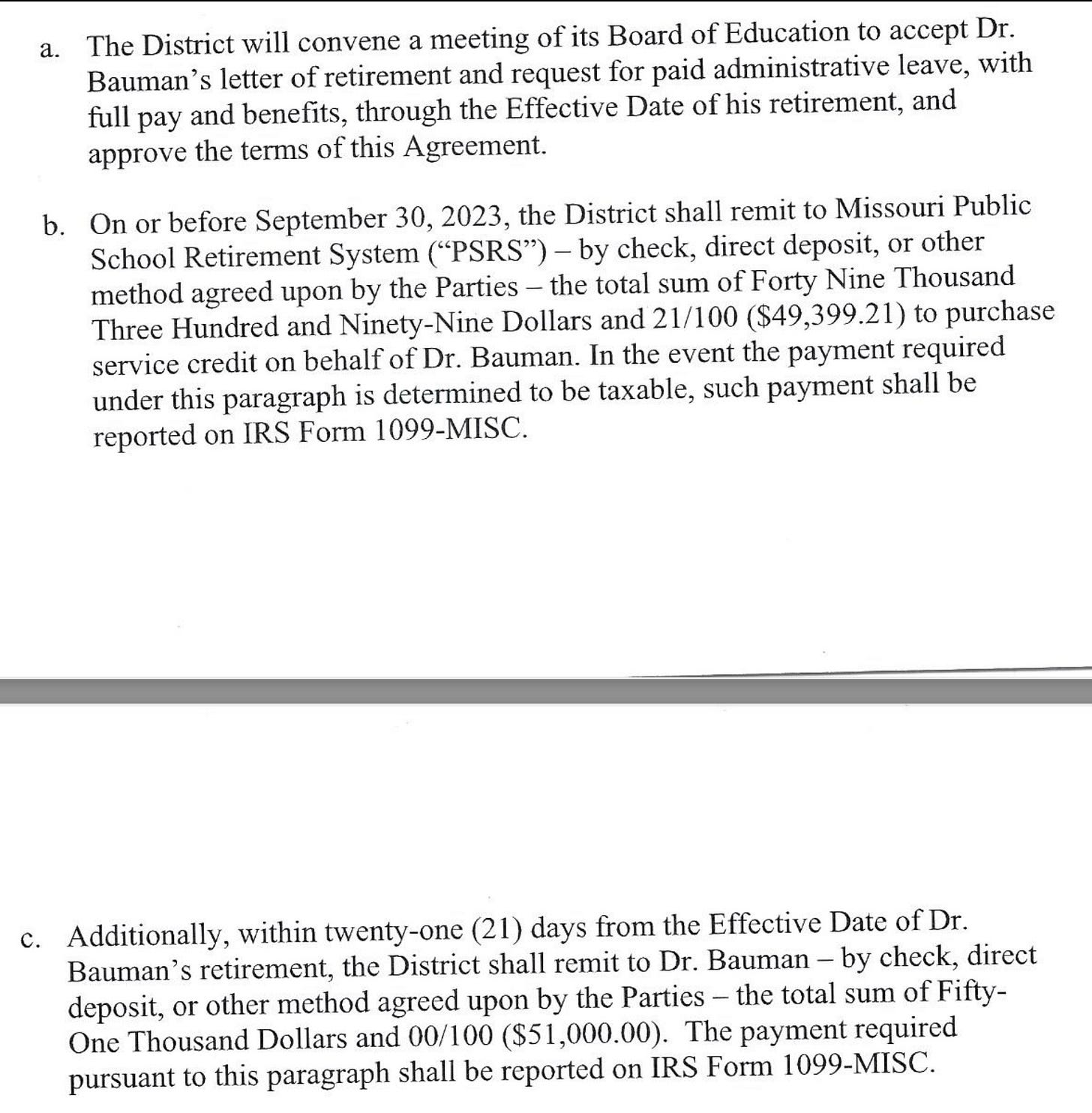

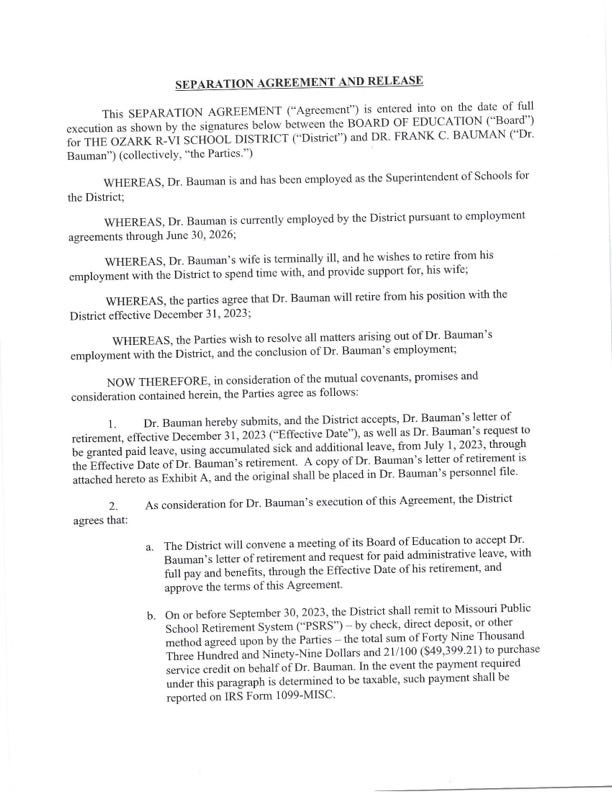

Here are the agreed payments to Dr. Bauman from the school district.

In the first Screenshot, we see the district agreed to pay to his retirement an extra $49,399.21. There is another article about how PSRS is a terrible burden on teachers, taking 14.5% of their paycheck and not giving them that money back if they leave within five years of education.

In paragraph C, we see they agree to pay him another check of $51,000 for his retirement.

In this screenshot, it appears they are paying for his families continued medical insurance through the district up to June 30, 2024 and after that they will move him to COBRA at his own expense. He retired in 2023, with May being his last month from what has been shared with me. They paid his health insurance for another year and a month.

Dr. Bauman was able to successfully negotiate for his “golden parachute” which amounts to a total of $100,399.21 plus the medical insurance. This could be as much as $800 a month or more, since I am assuming he was included with his family. If I’m right, thirteen months of extra pay comes up to $10,400.

*****Edit*****

PRIME CHOICE® was adopted in January by the School Board and did not affect the retirement of Dr. Bauman.

*****Edit*****

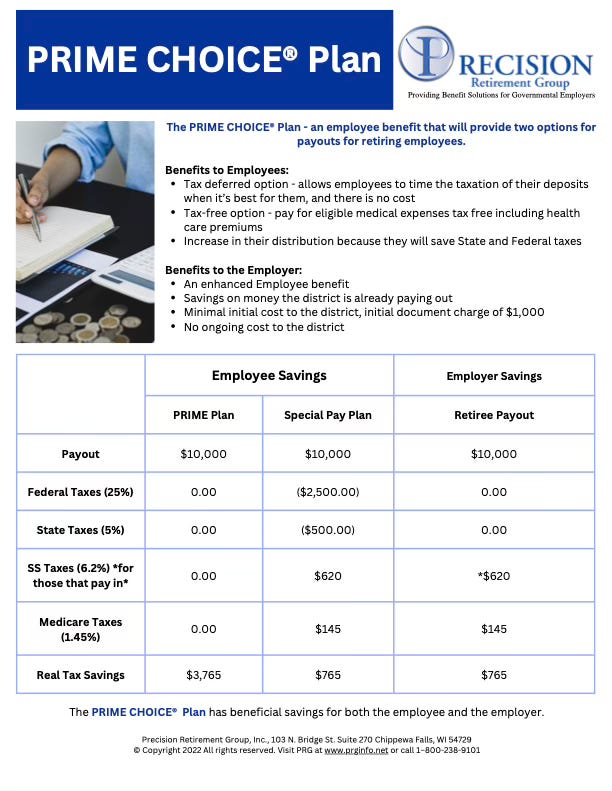

The School Board adopted the "PRIME CHOICE® Plan" offered by Precision Retirement Group, which allows public employers to convert certain forms of compensation like accumulated sick leave, vacation time, and incentive payments into contributions to either a medical trust called the "PRIME Plan" or special deferred compensation plans like 401(a) or 403(b) accounts. Copies of the Prime Plan are at the end of the article.

The materials promote these conversions as allowing tax-free reimbursements for retiree health expenses in the PRIME Plan trust, or opportunities to defer federal and state taxes in the deferred compensation plans. They also advertise eliminating FICA tax obligations for both the employer and employee.

While portrayed as benefits for employees, such specialized retirement plans allowing favorable tax treatments on back-end payouts have been criticized by some as forms of excessive "golden parachutes" for highly-compensated public officials and administrators.

Based on the district's publicly available salary records, at least four top executive administrators have annual compensation packages over $200,000. Applying the PRIME CHOICE® options could potentially enable these individuals to shield large portions of accrued leave payouts and bonuses from income taxes upon retirement.

The timing of the PRIME CHOICE® Plan's adoption also raises questions, as it was instituted under the previous superintendent who was reportedly aware of his own impending retirement. This has led to concerns over potential conflicts of interest and self-dealing in securing personal retirement benefits.

Reviewing this information, it is important for the reader to understand that the Missouri School Board Association (MSBA), which Ozark Public Schools is a member, was and is advocating against the Circuit Breaker statute which provides relief for Seniors and the Disabled.

*****Edit*****

The School Board also pays dues to the Missouri Association of School Administrators (MASA) and the Missouri Association of Elementary School Principals (MAESP). Along with the MSBA, they operate as Non-Governmental Organizations which try to lobby and enforce policy from above and outside the state on local schools.

*****Edit*****

MSBA-Missouri School Board Association

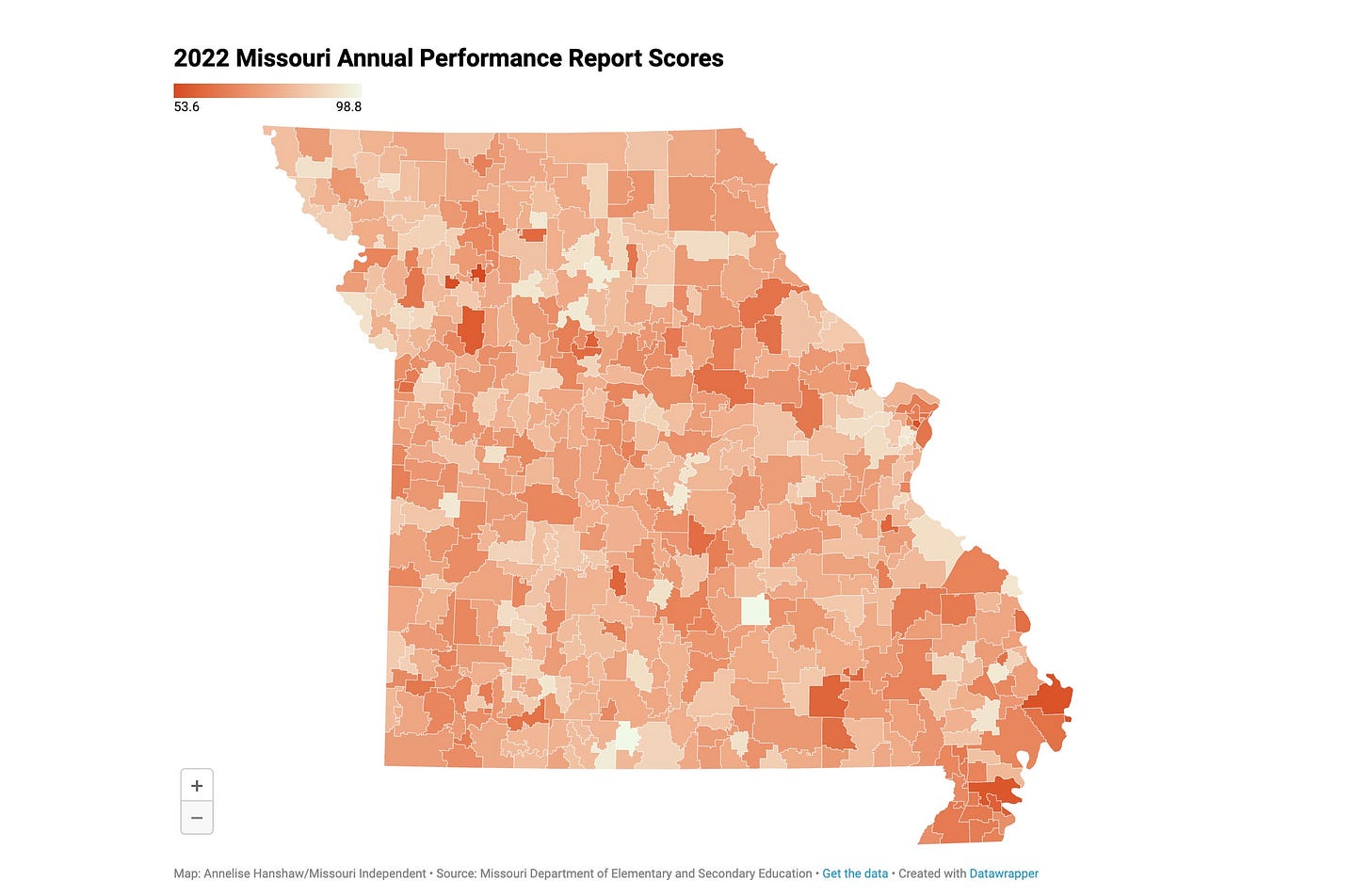

Currently, Ozark School Board Trustee, Patty Quesenberry, is President-Elect of the Missouri School Board Association and she is helping shape the MSBA’s legislative priorities. Here is a great write up of their priorities in 2022. Here is the link to their priorities in 2024. I encourage you to visit both links and review them. Look how many times the MSBA tries to discourage tax breaks, or fights against parental rights. The MSBA is willing to bankrupt every community if it promises a bigger budget to the school (while almost every school in the state is failing).

Images Credited to Missouri Independent.

Why are so many schools failing, though Ozark does manage a B? Why is the MSBA so focused on legislation that only benefits schools to make them wealthier, like ours spending $40M more than they did before Covid? Why aren’t their priorities more focused on supporting the children in the schools—or even supporting parents to choose the best schools for their own children through charter schools, no-strings vouchers, or homeschooling?

The MSBA’s bad policies are tied closely to the Ozark School Board. They are also trying to shut down School Board candidates in Springfield by using their Lawyer though a PAC called, United Springfield. Do we want them doing the same in our school district? Our county? This destroys local control and school districts like Ozark become extensions of St. Louis’ toxic groupthink and policies. In a previous article, I show the links between the United Springfield, the Chamber of Commerce, the MSBA, and Marxism.

Circuit Breaker Tax Breaks Extended

For those who are retiring for medical reasons, such as a disability or Seniors who are impoverished, the Missouri Legislative body passed this tax break despite strong opposition by taxing entities like Ozark Public Schools. The MSBA is currently pushing back against allowing this tax break to be extended to retired teachers and railroad workers. The MSBA represents our school district as a lobbyist. We should ask if the Executive Administrators, including Dr. Bauman, went to Jefferson City and participated in lobbying against this statute? What about lobbying against the Circuit Breaker extensions this year as they were able to negotiate a tax break for their current Exec Admin’s retirement. Again, I am sympathetic to Dr. Bauman, but because he and Dr. Lori Wilson, among others, are public officials. We are duty bound as citizens to ask these questions.

In her email response, Dr. Lori Wilson claims not to know about the Circuit Breaker Tax Bill, but is she playing word games with me? If I had instead asked about SB 190 (it’s official name), would she be able to identify it? Every tax paying entity in our county knew about this bill and are are of its current extension amendments, but the school is unaware? Or is it just Dr. Wilson?

Currently, is Dr. Wilson also advocating in the Capitol against her own tax-payers in her community—is she advocating against retired teachers from her own school with Patty Quesenberry? Teachers do not get golden parachutes and their retirement through PSRS is better than most, but it doesn’t provide free medical insurance for another year or so.

The district has offered a formal response to my questions, but I feel as if they are withholding information from the public.

Arguably, the entire premise of helping retired public employees legally avoid taxes on compensation conflicts with expectations of prudent stewardship of public funds. With the district facing budgetary challenges and pushing for increases to property taxes on residents, the fiscal judgment and priorities reflected in such arrangements warrant scrutiny.

As Ozark R-VI navigates financial straits, maintaining integrity and restoring public trust requires the board to evaluate compensation policies through an ethical lens - ensuring fairness, equity and responsible governance over taxpayer resources.

The content of the email I sent to the District requesting a response:

Dear Dr. Lori Wilson and Ozark R-VI Board of Education,

I am an independent journalist and concerned district taxpayer. Through extensive research of publicly available records, and confidential consultation with qualified accounting experts, I have uncovered details around two issues that raise ethical and financial integrity concerns.

First relate to the PRIME CHOICE® retirement plans newly adopted under the former superintendent's tenure. Based on salary databases, these specialized tax-advantaged vehicles primarily stand to benefit departing administrators with substantial six-figure compensation packages, arguably constituting "golden parachute" arrangements at taxpayer expense. At the same time the previous superintendent was negotiating his severance package, was he lobbying against the commonly known tax break, Circuit Breaker, for senior citizens. Does the school offer this golden parachute with tax breaks still to executive administrators while lobbying against retired teachers participating in an extension of the Circuit Breaker bill? If you aren’t lobbying directly by participating in Lobbying days at the capitol, are you paying dues to the MSBA, MASA, MAESP, or the MCSA?

Additionally, I have completed a detailed comparative analysis of the district's budgeting and actual expenditures over a multi-year period. The current 2023-2024 budget projects a nearly 5-fold overall increase, over $80 million, from 2020 actual spending levels within a four year window. There is no public evidence of major new infrastructure projects or operational service expansions to reasonably account for spending growth of this magnitude in such a condensed period. This trajectory is particularly concerning given it results in a $29 million budget deficit next year alone. Is the goal for the bond issue to pass so you can spend the $29 million?

As a matter of public interest, I am planning an in-depth investigative news articles around these two topics - the executive administrator retirement plans, and highly irregular budget expansion. However, I wanted to provide you the opportunity to offer an official justification, rationale or public response to the issues raised prior to publication. Please advise by March 4th, 2024 on whether you plan to provide such commentary. Additionally, please furnish any supplementary public domain budgeting records or projections that substantiate the district's extraordinary cost increases since 2020.

I will publish my articles on March 5th, 2024.

I recognize you all likely serve with a spirit of civic duty, so I welcome any clarification around these questionable areas that came to light. But as district residents face rising taxes, the board does owe taxpayers an obligation of financial accountability and transparency. I hope we can have a constructive dialogue. Please advise by the above deadline for inclusion in my upcoming article on these matters.

Regards,

David Rice

Dr. Wilson is well aware of SB190. She reported on it to the school board recently. She was very attuned to public sentiment and was diplomatic in her report.