The Curious Case of Library Support: Questions About Christian County's Foundation Model

As these two Foundations show up and try to speak out in the media and social media, are they actually providing value, or is their virtue signaling taking money from taxpayers?

Two Foundations—Almost no Return

The Christian County Library, like many public libraries across America, has cultivated relationships with supporting organizations designed to bolster its mission. In this case, two distinct entities have emerged: the Christian County Library Foundation and the Friends of the Christian County Library. These organizations present themselves as vital pillars of support for the library system, but a closer examination of public records reveals a more complicated picture.

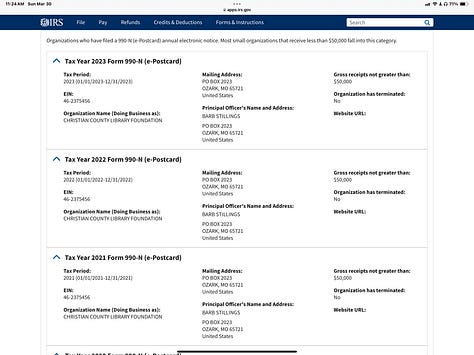

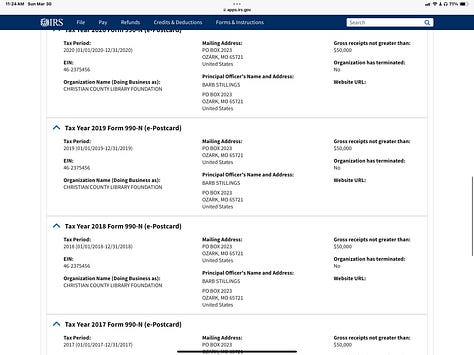

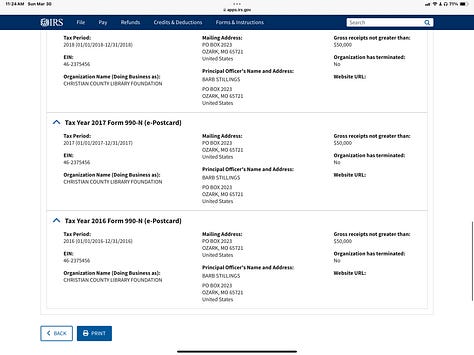

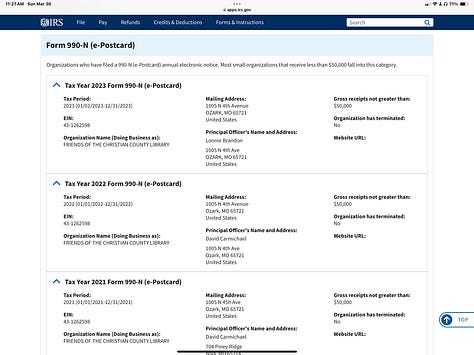

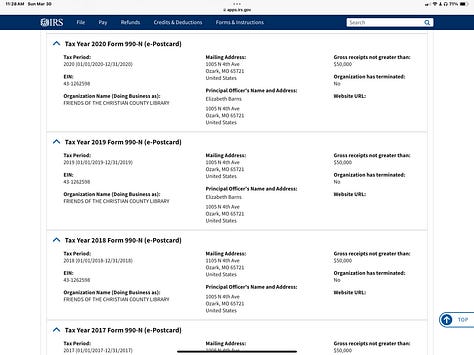

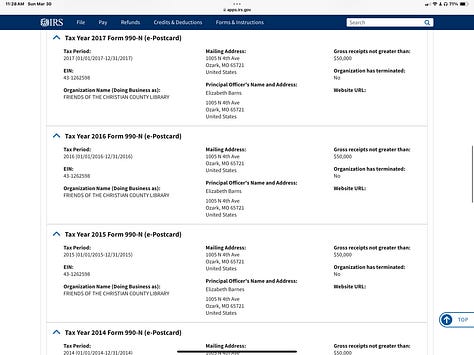

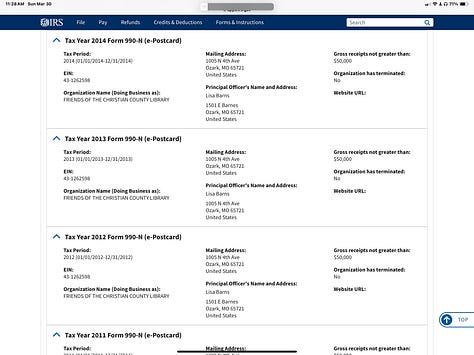

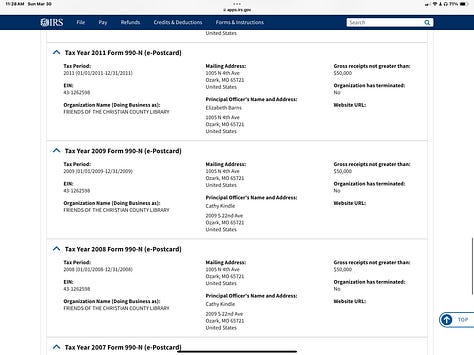

Both organizations file what's known as Form 990-N with the IRS—an "e-Postcard" filing option available only to tax-exempt organizations whose annual gross receipts are normally $50,000 or less. This simple fact establishes an important baseline: neither organization is raising substantial funds relative to the library's overall budget.

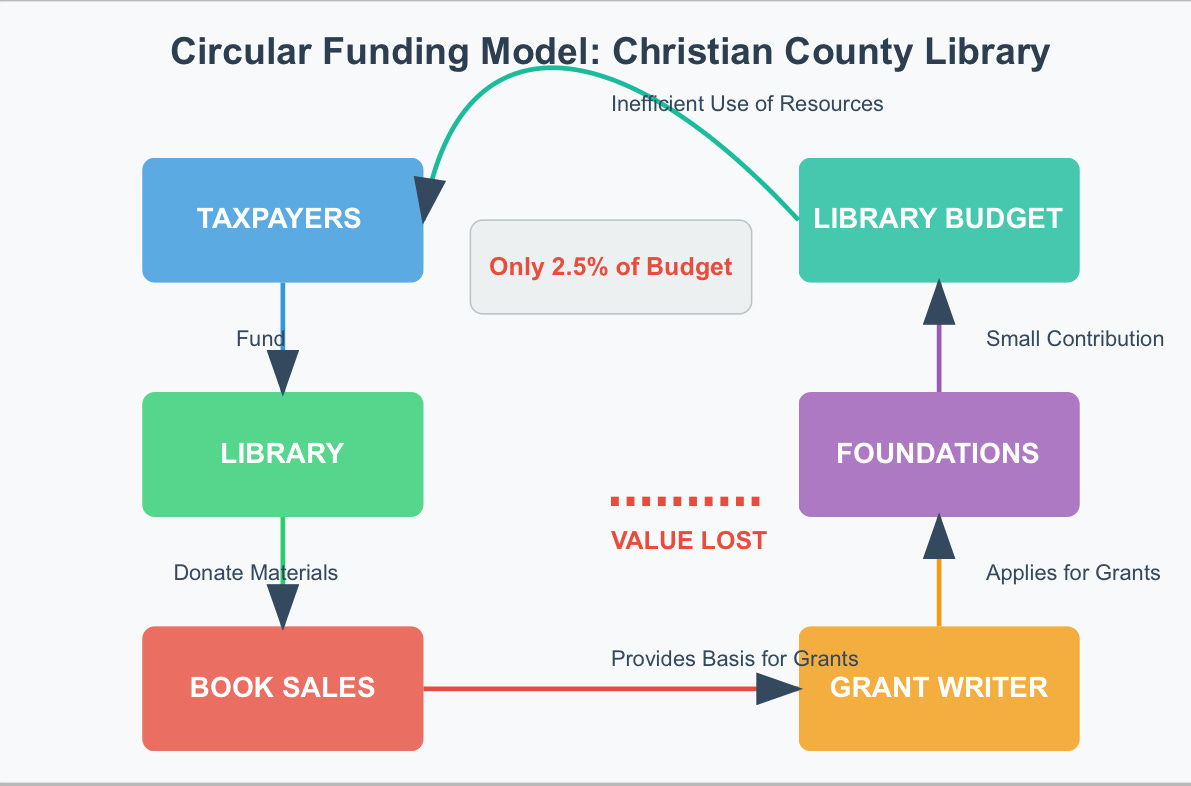

Follow the Money: A Circular Path

The most intriguing aspect of this relationship concerns the Friends of the Christian County Library. According to their website, their primary fundraising mechanism involves book sales. These aren't just any books, however—they're largely materials that originate from the library itself.

This creates a circular pattern of resource flow:

The library purchases materials with taxpayer funds

After these materials serve their circulation purpose, they're donated to the Friends group

The Friends group sells these items at modest prices ($0.50 to $2.00)

A portion of these sales returns to the library as "grants"

Meanwhile, the library maintains a grant writer position whose responsibilities include securing funds from these very organizations. This adds another layer to the circular flow: taxpayer money funds a position dedicated to retrieving a fraction of the value of taxpayer-funded resources that were originally donated by the library.

The Numbers Tell a Story

While detailed financial information awaits disclosure through a Sunshine Law request, some basic math reveals the limited scope of this support. With both organizations reporting under $50,000 in annual gross receipts, their combined maximum possible contribution represents roughly 2.5% of the library's estimated $4 million budget.

This percentage becomes even more striking when considering the administrative costs associated with maintaining these separate entities—officer positions, event planning, grant applications, and the portion of library staff time dedicated to coordinating with these organizations.

Appearances vs. Reality

What purpose, then, do these organizations serve? One possibility is that they create an appearance of robust community support and successful fundraising—useful narratives for library administrators and board members. The Friends group states on their website that their "#1 priority is to provide additional funding for materials and services not covered by the library's budget." Their listed accomplishments include "Summer Reading Challenges, book bins in the children's areas at every community branch location, a new service desk in Ozark and programming supplies."

These are worthy contributions, but they seem disproportionately small compared to the administrative infrastructure built around them.

Questions Worth Asking

As taxpayers and library patrons, community members might reasonably ask:

What is the actual value of materials donated to the Friends group annually?

What percentage of sales revenue makes its way back to the library?

How much does the library spend on grant-writing efforts directed at these organizations?

Would a direct sales model managed by the library itself be more efficient?

Could the resources currently devoted to this circular funding model be better utilized?

A pending Sunshine Law request seeks answers to these and other questions. Until then, the limited public information available suggests that the relationship between the Christian County Library and its supporting organizations may be more about maintaining appearances than delivering substantial financial value.

In a time when libraries face increasing budget pressures and scrutiny, ensuring that every dollar delivers maximum value for patrons should be a priority. The current arrangement—where resources make a full circle with diminishing returns at each step—warrants closer examination.

Note: This analysis is based on publicly available information including IRS filings and organizational websites. A more definitive assessment awaits detailed financial disclosures through Missouri's Sunshine Law.